Newsletter 2 - Told you so!

Are you curious about the latest developments in the financial markets and how to invest smartly?

In this new additional monthly edition of the Blokland Smart Multi-Asset Fund newsletter, I’m excited to share the latest updates and practical insights to help you grow your wealth.

The fund has now attracted over nine million euros in investments, and the number of participants continues to increase at a healthy pace.

Additionally, the fund achieved a solid return of 1.3% in September.

Are you interested in smart investment opportunities? Just schedule a quick meeting or get in touch to discover how the Blokland Smart Multi-Asset Fund can help grow your wealth. For more details, download the fund presentation here.

I also regularly organize events to meet in person and provide more in-depth discussions about the fund and the opportunities it offers. I hope to welcome you soon at one of these events!

Enjoy the read, and see you soon!

1. All-time high for the Blokland Smart Multi-Asset Fund

The Blokland Smart Multi-Asset Fund is doing well. In September, a return of 1.3 percent was realized. The fund's return is now at its highest level since inception, standing at 15% after fees as of the end of September.

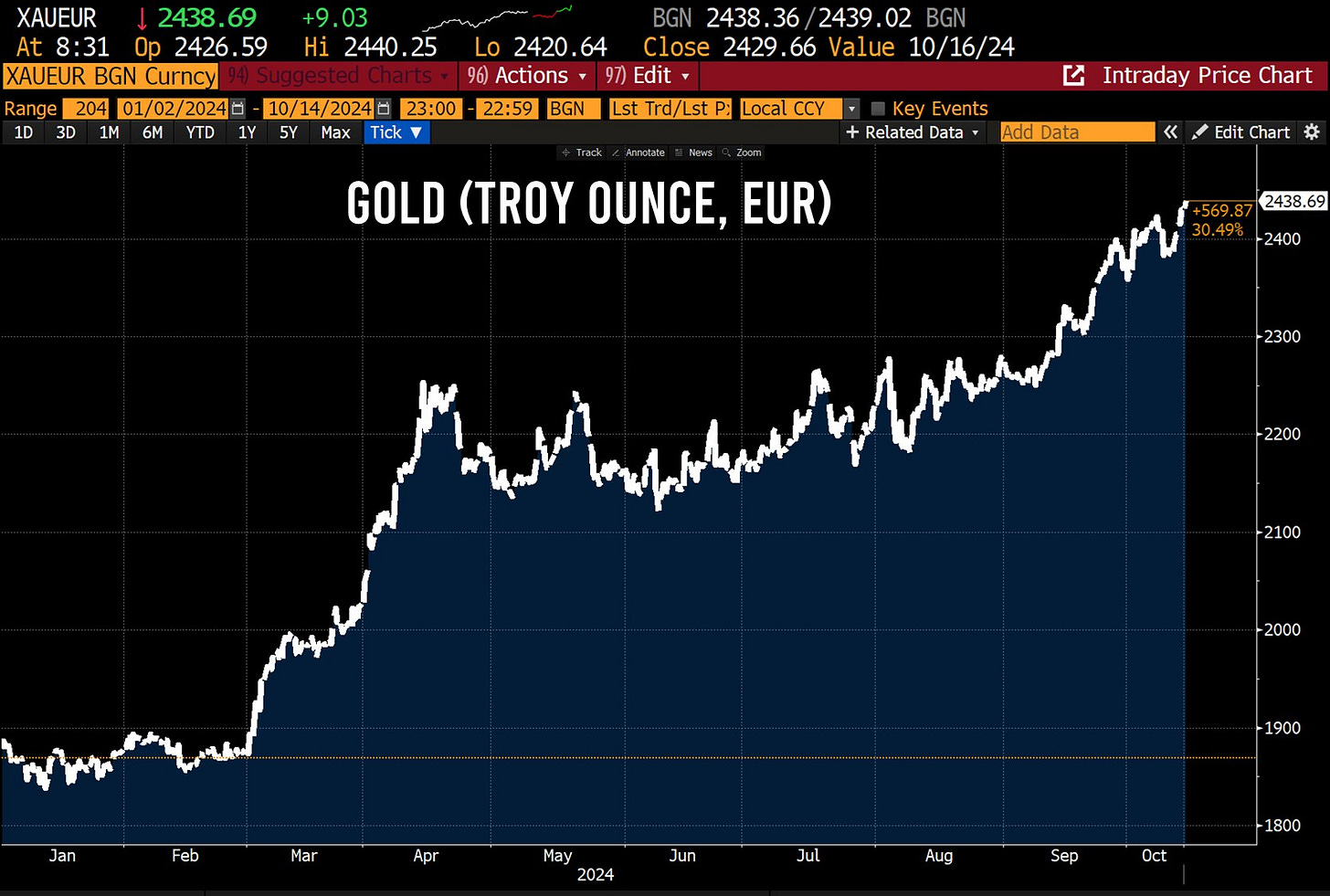

Gold was the main driver of last month’s performance. Gold reached a new peak in euros, but compared to the massive global money supply and debt, gold is still only at the beginning of its potential.

2. The Netherlands as an example

Based on recent data from the Dutch statistics office CBS, it is becoming increasingly clear that the Dutch economy faces massive challenges.

An aging population, declining economic growth, and increasing debt burdens pose a severe threat. And my home country is just an example. France, Germany, Japan, and even China face similar (if not worse) issues, putting pressure on the stability of their economies.

But what does this mean for investors and your wealth?

Key points:

Aging population and shrinking workforce: One-third of the Dutch workforce is between 55 and 75 years old, further strengthening the aging trend. By 2030, the workforce will shrink, further pressuring economic growth.

Increasing debt burden: The decline in economic growth due to the shrinking workforce leads to faster debt accumulation. Countries like France and China are seeing their debt levels soar due to a lack of growth and aging populations, making it harder to balance budgets.

Polarization and uncertainty around debt: The growing debt burden and the inability of countries like France to balance their budgets are leading to increased polarization and political unrest. The uncertainty about debt sustainability is making the bond market increasingly risky.

Pressure on interest rates and bond risks: The rising debt is increasing pressure to keep interest rates low, while risks for investors are rising. Bonds are becoming less attractive, and investors will need to seek out scarce assets to protect their wealth.

These developments force us to reconsider how we manage our wealth. The Blokland Smart Multi-Asset Fund can help with that.

3. U.S. inflation

I have analyzed the U.S. inflation figures for September, and a few things stand out. First, their importance is declining somewhat as Federal Reserve Chairman Jerome Powell has shifted his focus to employment. The labor market provides ample room to lower interest rates.

Second, with inflation at 2.4%, Powell & Co. must now decide how much to cut rates. Market experts suggest that the neutral level is close to 3 percent, meaning eight rate cuts of 0.25% are on the table.

In my view, the neutral level is lower when you take into account the unprecedented accumulation of government debt and budget deficits. The U.S. economy is also heavily reliant on financial markets.

In my opinion, there is no chance that the Fed won’t lower rates at the next FOMC meeting. This would put the Fed in a very uncomfortable position on their path to 'normalization.'

The next FOMC meeting is on Thursday, November 7th.

4. France

What’s going on in France? The popular holiday destination has become the epicenter of several dominant trends affecting all major economies.

France in the danger zone

France is stuck in a negative spiral. The country is grappling with structural problems, such as aging and a lack of economic growth, while fiscal stimulus and rising debt add further pressure.

Rising debt and political failure

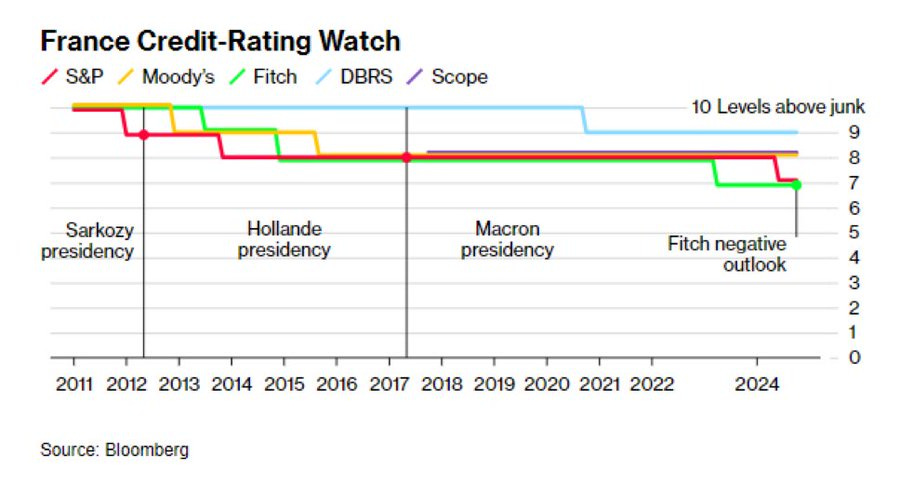

A major problem is the rising debt and increasing deficit relative to GDP. Fitch recently downgraded France’s credit rating to 'negative,' as the country has failed, and is unlikely to succeed, in keeping its budget deficit below 3% of GDP.

Doubts

The sustainability of France’s debt is increasingly being questioned, partly due to extreme monetary policies and the devaluation of the euro.

Without implementing structural reforms, the country can only hope for unorthodox solutions, like low interest rates and high inflation. There is also a plan to increase taxes on wealthy citizens.

Search for scarce assets

In this context, it makes sense to exchange bonds for scarce assets. The current policies create uncertainty and further polarize society without a real solution.

The urgency of the situation is evident in the chart below, showing the latest Fitch debt outlook downgrade.

5. Poor bond performance

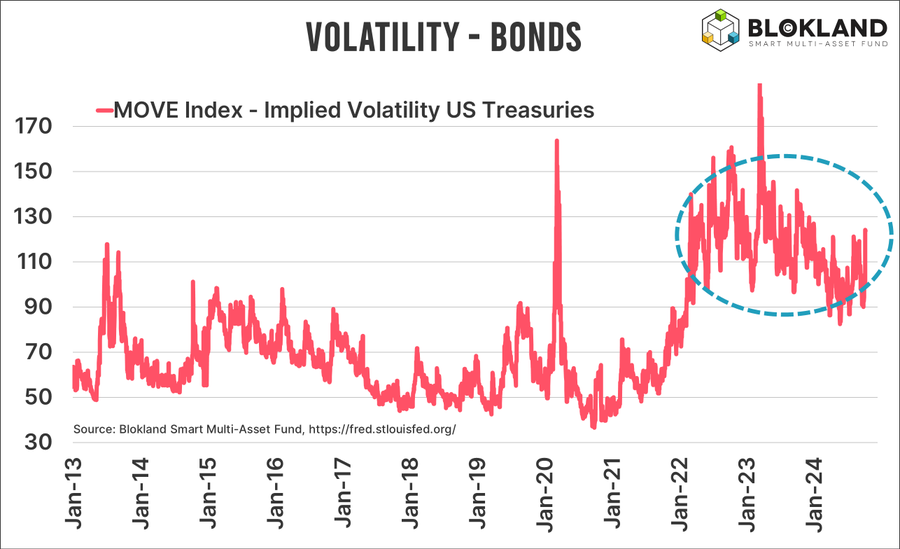

On the same day that the VIX Index, which measures expected volatility in the (U.S.) stock market, rose by 18%, the MOVE Index, which measures expected volatility in the (U.S.) bond market, shot up by 24%.

This is not what you would expect if:

Bonds are a safe haven

Stock and bond returns are negatively correlated

Debt risks are overblown

Moreover, the chart below shows that the (expected) volatility of bonds has been rising for the past 2.5 years. Not weeks or months, but years.

I continue to argue that bonds are structurally less attractive as an asset class due to low/negative (real) returns, higher volatility, and less diversification benefit—not just because I expect this, but because objective hard data confirms it.

It’s good to know: the Blokland Smart Multi-Asset Fund does not invest in bonds, but in quality stocks, gold, and bitcoin.

6. Saving is NOT a virtue: €17,000 poorer!

Using again The Netherlands as an example, but things look pretty much the same in other (European) places.

The Netherlands has €480 billion (!) in savings accounts. That’s more than half the size of the Dutch economy. But more importantly, it’s 'unwise.'

Many Dutch people have been raised, or perhaps I should say misled, with the idea that saving is good. Make sure you save something every month and put it safely in a savings account.

But your money in a savings account is NOT safe. Why? Very simple: inflation.

Based on the average interest rate according to the Dutch National Bank (DNB), your original €100,000 would now only buy €82,600 worth of groceries and other goods and services. You’ve lost over €17,000 in purchasing power. Just gone!

Now, I know some readers will say, "Yes, but at bank XYZ, you can get more interest."

That’s why the chart below also shows the purchasing power development of that €100,000 if you had earned the average interest rate plus one percent. Even then, you’re still €13,100 ‘poorer’ than in 2020, losing 13% of your purchasing power.

7. Book Tip: Economic Facts & Fallacies by Thomas Sowell

This time, a book tip: Economic Facts and Fallacies by Thomas Sowell. This book made me think about how policy decisions are made.

Sowell writes about how, in his view, economic myths often lead to bad policy choices. Over and over again.

This book confirms my belief that many market reactions are based on assumptions that are simply false. It’s refreshing to read such a down-to-earth perspective.

8. Meme of the Month

This is what Europe has become. A heavily indebted museum with little innovative and competitive strength that is struggling to find growth.

I regularly post memes on my Instagram page. Check them out here!

9. Contact me directly

Are you interested in the Blokland Smart Multi-Asset Fund? You can schedule a call directly via this link! Beforehand, feel free to review the terms in the fund presentation, which you can find here.

You can also reach me at:

Phone number: +31 6 14 37 19 35

Email: jeroen@bloklandfund.com

Online meeting: Schedule an appointment here

That’s all for this edition. As always, feel free to reach out if you have any questions or would like to discuss your investment strategy further.

Let’s invest together!

Kind regards,

Jeroen