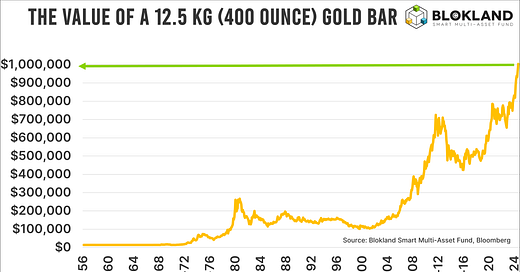

Hooray: Gold Now Worth Over 1 Million!

But more importantly: The purchasing power of gold has increased far more than that of other scarce assets, such as houses.

If you're fortunate enough to own a 12.5 kg gold bar, its value has now soared beyond one million US dollars—an astonishing milestone.

Tenfold!

The chart above provides an even more compelling illustration of gold's value trajectory. Back in 2001, a 12.5 kg gold bar was valued at just USD 100,000. In less than 25 years, the price of gold has increased tenfold. Not bad for an asset class that many investors and economists still dismiss as a 'pet rock' with no income stream.

Sure, the 'USD 1 million' headline grabs attention, but to me, it's an opportunity to delve into what this dramatic rise in gold's value signifies. What does this extraordinary surge truly represent? Clearly, with its tenfold increase, gold has far outstripped inflation, significantly boosting its purchasing power.

Buying more homes

The next chart offers a concrete visualization of the concept of purchasing power. The line in the graph tracks how many homes you could purchase in the US over time with a single 12.5 kg gold bar. To calculate this, I divided the price of that gold bar by the price of an 'average' home in the United States. I then smoothed the gold price/home price ratio over 36 months.

For instance, in 1956, at the beginning of my data series, a 12.5 kg gold bar would buy you roughly 0.75, or three-quarters of a home in the US. Today, the ratio has risen to two. You can now purchase two average homes in America with one 12.5 kg gold bar. In other words, if you had acquired such a bar in 1956, you could now afford '1.25' more homes. Not bad, right?

The chart also vividly illustrates that the gold/home ratio isn't constant, except from 1956 to 1972 when the gold standard was still in place. After the Great Financial Crisis—triggered by the rampant (re)selling of subprime mortgages leading to a massive drop in US housing prices—you could have bought more than three homes with a 12.5 kg gold bar.

Gold is a hugely attractive investment

The chart above highlights two important points. First, in a world awash with debt and fiat currencies like dollars and euros, measuring wealth in alternative units, such as homes, makes sense. Second, it underscores that gold, as a scarce asset, has massively outperformed US homes, also relatively scarce, in terms of return.

Fear of heights?

Finally, after witnessing such spectacular trends, investors may start to wonder if gold has reached its peak. In the short term, that can always become the case. As we've seen with recent events in Japan, when panic truly strikes the markets, nearly every asset tends to decline simultaneously.

However, the outlook remains outright positive in the medium to long term. According to my 'The Great Rebalancing' theory, every day, some investor will wake up, have a look at charts like the ones above, along with those showing rising debt, growing uncertainty, and extreme central bank policies, and will decide to allocate a portion the accumulated wealth to gold. Moreover, central banks, also very aware of what is happening, are following suit. Yet, the amount of gold held by central banks remains historically low.

I hope this newsletter has provided you with valuable insights, not only about the value of gold but also on how to interpret it.

Interested in the Blokland Smart Multi-Asset Fund?

Contact me at jeroen@bloklandfund.com or visit the website.

Want to have a call first? Use this link to book a one-on-one conversation and choose a suitable time slot. You can opt for a Zoom meeting or a phone call. Please note that the minimum entry amount is EUR 250k, which can be lowered to a minimum of EUR 100k in consultation.

Let’s invest together!

Kind regards,

Jeroen