Market update March 12

Markets Under Pressure Due to Economic Uncertainty and Geopolitical Tensions: Key Figures, Risk Management, and Outlook

Sentiment Shifts

In recent days, market sentiment has deteriorated further. Alongside persistent (geo)political tensions, uncertainty about the health of the U.S. economy has grown significantly. Investors are becoming increasingly cautious as they assess the potential implications for financial markets. This update provides a closer look at the current landscape.

Market Developments

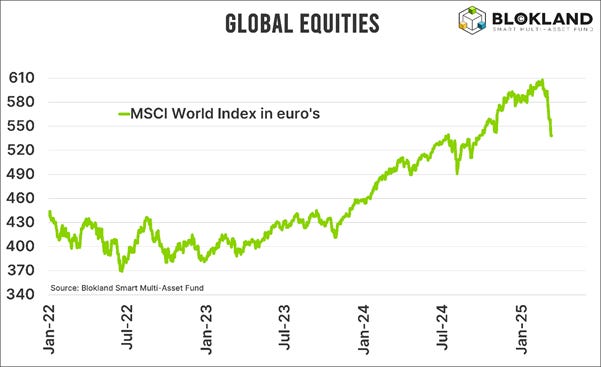

As of this writing, the MSCI World Index, measured in euros, has declined approximately 10% from its mid-February peak. This level of decline typically qualifies as a market correction. Historically, stock markets experience an average intra-year drawdown of around 13%, making the current downturn well within the normal range of market fluctuations.

A significant portion of this decline can be attributed to the euro’s sharp appreciation against the U.S. dollar, which has strengthened by approximately 5.5%. Given that U.S. equities dominate global equity indices and that gold and Bitcoin are priced in dollars, this currency movement has had a meaningful impact on the fund’s performance.

Gold, measured in euros, is down approximately 6%, though in U.S. dollars, it remains just 1% below its all-time high.

Bitcoin has declined by 7% in euro terms, following a period of increased volatility.

Quality stocks have fallen less than the broader MSCI World Index, with a decline about 1% smaller than the overall market. This is consistent with their historical resilience in uncertain conditions.

Activation of the emergency brake

Given the recent surge in market volatility, the ‘Emergency Brake’ has now been activated for both stocks and Bitcoin. This marks the first time since the fund’s inception that the Emergency Brake has been applied to equities, whereas for Bitcoin, it has been triggered on several occasions.

The exact impact on returns will only become clear once the Emergency Brake is lifted, but what is certain is that it plays a crucial role in reducing downside risk and limiting potential losses if market sentiment continues to weaken.

Economic and Political Uncertainty

The combination of Trump’s aggressive policy stance, including continuous tariff implementations, and growing economic concerns has led investors to adopt a more defensive positioning. That said, a U.S. recession is far from certain. If economic conditions worsen, Trump is likely to adjust his strategy, as he has done in the past.

Additionally, in such a scenario, the Federal Reserve still has ample room to cut interest rates to stimulate growth.

Long-Term Outlook

While the strong U.S. dollar has weighed on the fund’s short-term returns, a weaker dollar over the longer term could actually provide more favorable financial conditions. Since much of the global economy still relies on the U.S. dollar, a weakening of the currency could help ease market pressures and improve liquidity conditions.

More importantly, the long-term investment thesis remains unchanged. The European Union is moving forward with plans to allocate hundreds of billions of euros toward defense, infrastructure, and innovation. As geopolitical tensions persist, particularly related to Ukraine and the United States, rising government debt levels seem inevitable. Given this backdrop, higher interest rates are the last thing European policymakers want.

If these large-scale spending initiatives are realized, massive amounts of capital will flow into the economy, fueling inflationary pressures. This reinforces the core investment philosophy of the Blokland Smart Multi-Asset Fund:

📌 In a world of rising debt, low interest rates, and inflation risks, scarce assets like gold, Bitcoin, and quality stocks are the best long-term investment strategy.

Interested in the Blokland Smart Multi-Asset Fund?

Contact me at jeroen@bloklandfund.com or visit the website.

Want to have a call first? Use this link to book a one-on-one conversation and choose a suitable time slot. You can opt for a Zoom meeting or a phone call. Please note that the minimum entry amount is EUR 100k.

Let’s invest together!

Kind regards,

Jeroen