Newsletter 10: So-called ‘Safe’ Investments Are Becoming Increasingly Risky

Welcome to a new edition of the Blokland Smart Multi-Asset Fund newsletter

The financial world is shifting.

New geopolitical tensions are flaring up, while central banks are walking a fine line between controlling inflation and financing ever-growing public debt.

In this edition, I explain why savings accounts and government bonds no longer offer meaningful protection, and why scarce assets like gold, Bitcoin, and quality equities are making all the difference. Topics covered include:

• The Iran–Israel conflict

• Defense spending is now mandatory

• Savings rates down again

• Bitcoin vs. the Nasdaq

• China is buying gold

• Private equity + private debt = one big risk?

In this monthly newsletter, alongside my regular posts, I also share the latest updates on the Blokland Smart Multi-Asset Fund and provide practical tips to help you grow and protect your wealth.

Want to benefit from these smart investment strategies?

Book a free consultation or reach out to discover how the Blokland Smart Multi-Asset Fund can help grow your capital.

I also regularly host in-person events and meetups where we dive deeper into the fund, the strategy, and the opportunities ahead.

Enjoy the read,

Jeroen Blokland

Iran–Israel War

Israel launched strikes on Iran, prompting a drop in equity markets. Geopolitical tensions and flashpoints are difficult, if not impossible, to predict.

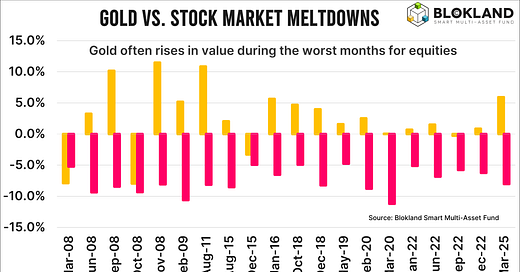

That’s precisely why a well-diversified investment portfolio is essential. But only if it’s constructed properly. In that context, gold and equities have proven to be an outstanding combination.

In 80% of the 20 worst-performing months for equities since 2008, the price of gold actually rose. Brace yourself: the average return on bonds during those same months was negative.

Read more here:

Almost no one invests in gold

Bonds erode your purchasing power

2. Defence spending is now mandatory

Why do you think Europe’s “Readiness 2030” program (formerly Rearm 2030) allows for larger deficits and joint Eurobonds?

Because debt has become structural. Defence spending is now treated as mandatory, just like pensions and healthcare.

That changes everything. Public finances are rudderless without growth, and central banks are drawn ever deeper into the picture. The debate over monetary financing and central banks funding government spending is no longer taboo.

What does this mean in practice?

Interest rates must fall to keep debt serviceable. Inflation will be tolerated—or even deliberately pursued—to inflate away debt.

Cash savings and bonds will continue to lose value. In this regime, one strategy remains: investing in scarcity.

3. Netherlands cuts savings rates

This topic is focused on my home country, the Netherlands, where savings rates are extremely low, but it applies to many other places as well.

Another reminder that saving doesn’t pay: Nationale Nederlanden has lowered its savings rate again. It now sits at just 1.4%. For balances above €25,000, the rate is even lower—1.3%.

ING’s top rate only applies to the first €10,000. Not only are rates falling, but the thresholds to earn them are falling too.

Dutch inflation in May was 3.3%, with a 12-month average of 3.6%. Do the math.

Below, you can see how €100,000 in savings has developed since 2020. Yes, there was some interest, but inflation steadily eroded the real value of your money.

The takeaway is clear: interest gains are dwarfed by inflation. Even at average savings rates, the real value of €100,000 has declined by nearly 20%.

Inflation and low interest rates have slashed your purchasing power by 20%. That’s enormous. Your account balance might rise slightly each month, but in reality, you're losing ground. Saving is no virtue.

How is this in your country?

4. Japanese government bonds

The Bank of Japan kept rates near zero for years by purchasing massive amounts of government bonds. This not only suppressed yields but also neutralized natural market volatility.

Now that the policy is being partially unwound, the hangover is hitting hard: Japanese government bonds have posted average annual losses of nearly 4% over the past four years, even before inflation. Volatility has more than doubled. Investors are now taking more risk for worse returns.

This is what happens when central banks distort markets for too long and then step back.

The consequences are severe. Investors, pension funds, and savers still holding Japanese bonds have seen their capital erode. They’ve been trapped. With yields held down for so long, nearly all “safe” assets became unattractive.

But many large players couldn’t, or wouldn’t, exit. They remained stuck in real-term wealth-destroying assets for years.

This so-called “yield curve control” has a dark side: it distorts markets, misprices risk, and penalizes savers.

It shows how central banks can manipulate outcomes, but also how dangerous that becomes when inflation rises or trust falters. This is how bond market chaos begins.

5. Will Bessent succeed Powell as Fed Chair?

U.S. Treasury Secretary Scott Bessent is now being floated as a possible successor to Jerome Powell as Federal Reserve Chair.

If that happens, the man overseeing U.S. fiscal policy would next control interest rates, and possibly the central bank’s asset purchases.

That raises fundamental questions about Fed independence. Under Paul Volcker or Alan Greenspan, the Fed kept a firm distance from the Treasury. That boundary may now disappear.

Historical context: No sitting Treasury Secretary has ever become Fed Chair.

If Bessent does take over in 2026, it would mark a historic shift toward fiscal dominance, where monetary policy is subordinated to the sustainability of public debt. Price stability becomes secondary to keeping rates low enough to afford interest payments.

6. Bitcoin and the NASDAQ

In my latest blog post, I debunk the myth that Bitcoin is simply a turbo-charged version of the NASDAQ.

The chart below compares the correlation between the NASDAQ and Bitcoin (green line) and the NASDAQ and high-yield bonds.

High-yield bonds are issued by companies with low credit ratings—typically those with fragile balance sheets, low earnings, or cyclical vulnerability.

I analyzed return correlations over a longer time frame. Despite what some experts claim, the correlation between NASDAQ and Bitcoin is nowhere near 1.

It hovered near zero for years, rose slightly more recently, and now sits around 0.4, well below perfect correlation. The trend is also reversing.

The data simply doesn’t support the “Bitcoin = NASDAQ on steroids” narrative.

7. U.S. inflation

The Federal Reserve held rates steady, keeping the benchmark at 4.25%–4.50%.

This means monetary easing remains on hold. The Fed’s latest projections indicate only two rate cuts in 2025—just 50 basis points in total.

U.S. inflation in May surprised slightly to the downside:

Headline inflation: 2.4% year-on-year (expected: 2.4%), 0.1% month-on-month (expected: 0.2%)

Core inflation: 2.9% year-on-year (expected: 2.8%), 0.1% month-on-month (expected: 0.3%)

Still, Powell made clear that the Fed won’t act until the full effects of tariffs on inflation are understood.

9. China and gold

China remains bullish on gold.

Once again in May, China increased its gold holdings—partly through unofficial channels.

While its official reserves still trail far behind the U.S. and Europe, China’s intentions are clear: reduce exposure to the U.S. dollar.

Trump’s trade war only accelerated this de-dollarization push.

Still, China knows few want to hold yuan.

So the question isn’t whether China will keep buying gold—it will.

The real question is: will you follow their lead, or stick with euros?

9. Paul Tudor Jones on inflation hedging

Legendary investor Paul Tudor Jones told Bloomberg his ideal inflation hedge consists of gold, Bitcoin, and stocks.

That’s exactly what I do in my fund. Curious to learn more? Let’s connect.

10. Private equity + private debt = one big risk?

It’s almost elegant: private debt firms are now lending to private equity firms, because the latter can’t exit investments or return capital to clients.

But the underlying picture is less flattering:

Private equity doesn’t consistently deliver superior returns—there’s too much capital chasing too few quality deals.

When you adjust (“desmooth”) private equity returns, their volatility actually exceeds that of listed equities.

And correlation with public markets is far higher than often claimed. Diversification? Not really.

These supposedly “alternative” assets are becoming deeply intertwined. Correlation, anyone?

Family offices now allocate 25% of portfolios to private equity and debt. Why? Slick marketing.

See the chart below for context.

Wealth managers push these assets like miracle solutions. But the reality is: high fees, illiquidity, and underwhelming returns.

We take a different path.

11. Europe needs a reality check

A new column is on its way. Subscribers will receive the full version.

Here’s a preview to reflect on:

The hard data is clear: Europe is no longer a meaningful driver of global growth. As countries like China, India, and even Turkey shape the future, Europe clings to overregulation, political paralysis, and illusion.

Leaders still dream of the euro as a global reserve currency—but ignore housing shortages, energy insecurity, and long-standing competitiveness gaps.

As long as Europe assumes it belongs at the top table by default, it will remain on the sidelines. It’s time to face reality and act.

12. Meetups, events & media

At the Blokland Fund, we continue to focus on scarce assets like gold and Bitcoin. This strategy offers protection in a world of mounting debt and geopolitical instability.

Gold retains its safe-haven status, while Bitcoin increasingly acts as digital gold. Both offer scarcity—and that matters when rules and power structures shift.

Europe, meanwhile, is stuck between excessive regulation and widening deficits. That’s exactly why scarcity isn’t a trend—it’s a strategy. I explained this recently at Grizzle

ByteTree

As tensions between Israel and Iran escalate, more countries seek to move away from the U.S. dollar. Bonds no longer yield. What should investors do? I discussed this with two other fund managers who also prioritize scarce assets.

Find the ByteTree podcast here.

12. Contact me directly

Are you interested in the Blokland Smart Multi-Asset Fund? You can schedule a call directly via this link! Beforehand, feel free to review the terms in the fund presentation, which you can find here.

You can also reach me at:

Phone number: +31 6 14 37 19 35

Email: jeroen@bloklandfund.com

Online meeting: Schedule an appointment here

That’s all for this edition. As always, feel free to reach out if you have any questions or would like to discuss your investment strategy further.

Let’s invest together!

Kind regards,

Jeroen