Newsletter 8: Trade War, Gold roars, Inflation up + Bond Market Drama

From Trump to inflation, and from gold to bitcoin – the most important market insights and what they mean for your portfolio.

Welcome to my monthly newsletter!

Curious about the latest trends in financial markets and how to grow your wealth wisely? In this newsletter, I share:

Trump’s import tariffs and the heavy market reaction

Equities outperforming bonds

Gold proving to be the ultimate safe haven

Bitcoin price remains resilient

Inflation expectations are rising

The real risks to your pension

In addition to my other posts, this monthly newsletter gives you the latest updates on the Blokland Smart Multi-Asset Fund, along with key market insights and practical tips for building long-term wealth.

Want to benefit from these smart investment opportunities? Book a call or get in touch to learn how the Blokland Smart Multi-Asset Fund can help grow your capital.

I also regularly host events to connect in person and explore the opportunities the fund offers.

Happy reading!

Best regards,

Jeroen Blokland

1. Shockwave

President Donald Trump’s import tariffs sent shockwaves through financial markets. Stocks plummeted, and although there was some recovery, the S&P 500 Index remains significantly below its February peak.

Everything about the current market dynamic is a big “WOW,” as I shared earlier this month. With the VIX at 50, high dollar volatility, and sharp interest rate swings, this is a cocktail that demands vigilance.

For the Blokland Smart Multi-Asset Fund, this once again confirms the importance of:

Strict risk management

Scarce assets (such as gold)

Global diversification

How are we responding? First, the "Emergency Brake" has been activated for both equities and bitcoin. This mechanism protects investors from heavy losses, and equally important, the psychological stress that often leads to poor decision-making.

The Emergency Brake is designed to limit losses during crises, but it won’t catch the bottom of the market. It doesn’t necessarily increase returns, but it helps investors avoid emotionally driven mistakes by enforcing clear risk boundaries.

That, to me, is a key strength of the Blokland Smart Multi-Asset Fund.

2. Equities outperform bonds

Despite all the market turmoil, equities are outperforming long-term bonds. Let that sink in for a moment.

Since “Liberation Day” on April 2, when Trump announced the import tariffs, markets have remained highly volatile. Yet, long-term bonds have fared worse, offering no protection at all.

This once again confirms my conviction: in crises like this, bonds fail to deliver. See the chart and further analysis in section 12, my column “Coverage Ratio Drama.”

3. Gold proves the ultimate safe haven

Gold is also outperforming silver. While gold prices surged to all-time highs (above $3,300 per ounce), silver plunged over 7% on Liberation Day, to $32.17, and has barely recovered.

The weakening US dollar, now at 1.14 against the euro, is a key factor here. Gold benefits from this as the ultimate safe haven.

The Blokland Smart Multi-Asset Fund holds physical gold, not only for its historical store-of-value characteristics. In times of geopolitical stress, currency depreciation, and rate volatility, gold continues to offer the most stable protection.

During the recent market turmoil, gold once again hit a record high:

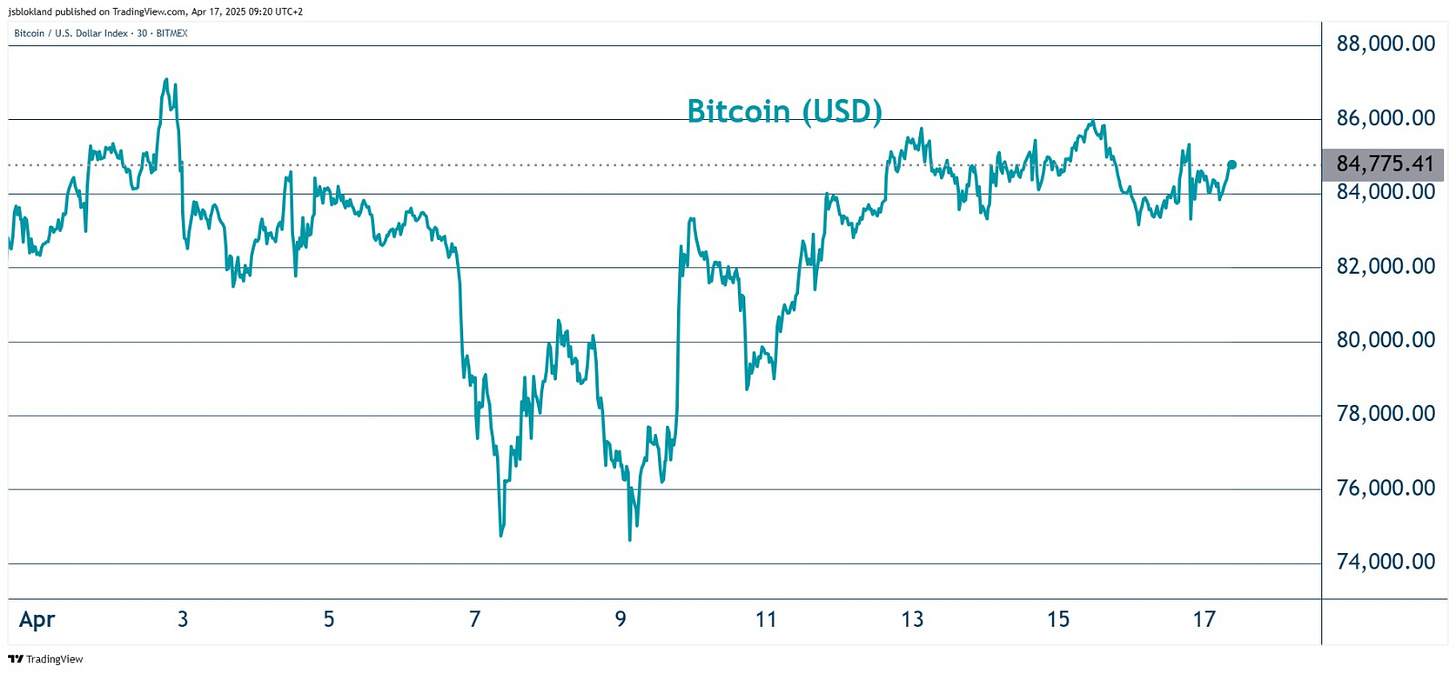

4. Bitcoin remains resilient

Despite the market chaos, Bitcoin has held up well. In USD terms, it shows a similar pattern to gold, though less pronounced. This is partly due to the declining dollar.

When the dollar falls, assets priced in dollars naturally rise in value. Interestingly, Bitcoin hasn’t followed equities downward this time.

At the time of writing, Bitcoin trades around $84,000, about 20% below its all-time high, but significantly higher than it was a year ago.

5. Weakening US dollar

The drop in the US dollar is becoming chaotic. Tensions escalated after China blocked another attempt by Trump to reverse trade policy.

China matched US tariffs at 125%, pausing the trade war (excluding China) for three months. But market uncertainty remains.

6. China’s trade surplus

Although China’s economy is struggling, its trade surplus continues to impress. In early 2025, it hit a record $140 billion in a single month.

The chart below shows that China’s trade surplus has remained positive since 2005, despite major disruptions like the global financial crisis and COVID-19.

Notably, China joined the WTO in 2001, clearly visible on the graph.

Summary:

China remains a dominant export power

Domestic demand stays weak

These surpluses fuel global trade tensions, increasing the likelihood of new tariffs or sanctions from the US

7. Inflation is here to stay

Global markets are unpredictable, but central banks remain consistent: they insist inflation will eventually return to target.

Terms like “transitory,” “cyclical,” or “geopolitically driven” are frequently used.

But consumers and businesses are taking inflation expectations seriously. A recent New York Fed survey shows that US households expect 3.6% inflation over the next year, which is undoubtedly a high number driven mainly by tariff-related tensions.

Persistently high expectations can fuel a self-reinforcing cycle of rising wages and prices.

This is why investing in scarce assets is more important than ever to preserve purchasing power.

8. Saving no longer works

Inflation isn’t just a feeling. The St. Louis Fed chart below shows how hard it has hit US cities from Q1 2019 to Q1 2024. It’s dramatic.

Tampa leads with a 32% price increase. Phoenix, Miami, and Atlanta follow closely.

Wages have risen, but savers and bondholders have still lost significant purchasing power.

The takeaway: Saving is no longer safe. Investing in scarce assets, such as gold, bitcoin, and high-quality companies, is now a necessity.

Interested in the Blokland Smart Multi-Asset Fund? Book a call here.

9. Trump’s impact felt in the Netherlands

Dutch chip giant ASML reported disappointing orders: €3.94 billion vs. the expected €4.82 billion.

A clear sign that global trade tensions are hitting the tech sector. Even tech stocks, while partly exempt from Trump’s tariffs, are clearly affected.

Will Trump stick to his trade stance, or will markets force a rethink?

For investors, this highlights the need for global diversification and robust risk management.

10. Germany reacts to new US policy

Germany is feeling the effects of the new American policies, too.

ZEW (Center for European Economic Research) had a striking headline on its homepage: “Liberation Day causes ZEW indicator to plunge.”

German investors briefly felt optimistic due to billions allocated for defense and infrastructure. But Trump’s new direction reversed that sentiment quickly.

11. Coverage Ratio Drama

The real hit to pensions isn’t from bear markets, but from relying too much on bonds.

My column in Investment Officer (Dutch) makes this point. The latest stock plunge sparked dramatic headlines, like De Telegraaf’s: “Pension funds tremble from market turmoil.”

But the problem isn’t stocks, it’s bonds delivering near-zero returns while inflation soared.

If Dutch pension funds had held just 10% gold over the past 20 years, they would have seen far better returns and higher coverage ratios.

The issue isn’t the equity market, it’s missed opportunities from outdated, overly conservative strategies that favor bonds.

12. Meetups, events & media appearances

I recently attended two events on crypto investing, which for me means Bitcoin.

Both Amdax and Financial Investigator hosted great discussions. It’s clear the gap between traditional finance and Bitcoin remains wide.

Traditional investors highlight risks such as volatility and a lack of cash flow. Bitcoin enthusiasts want to completely dismantle the old system with nothing in between.

I see myself more and more as a bridge between these two worlds.

Zürich days

I gave a keynote speech at the Mining Forum Europe 2025 in Zürich, on scarcity, macroeconomics, and tangible assets like gold and Bitcoin.

I also personally audited the physical gold held by the Blokland Smart Multi-Asset Fund. With bar numbers in hand, I visited the vault.

No shiny pyramids—just boring, securely stored bullion. But essential to verify that our scarce assets are really there.

13. Meme of the Month: Gold keeps climbing

Gold continues to perform. At the time of writing, gold trades at €93,499 per kilo—around €2,908 per troy ounce.

14. Contact me directly

Are you interested in the Blokland Smart Multi-Asset Fund? You can schedule a call directly via this link! Beforehand, feel free to review the terms in the fund presentation, which you can find here.

You can also reach me at:

Phone number: +31 6 14 37 19 35

Email: jeroen@bloklandfund.com

Online meeting: Schedule an appointment here

That’s all for this edition. As always, feel free to reach out if you have any questions or would like to discuss your investment strategy further.

Let’s invest together!

Kind regards,

Jeroen