Newsletter 9: Inflation Devours Bond and Savings Returns

Banks Shortchange Savers – And What You Can Do About It

Welcome to the monthly Blokland Smart Multi-Asset Fund newsletter!

Curious about the latest trends in global financial markets—and how to grow your wealth strategically?

In this edition, I cover key developments shaping today’s investment landscape:

A pause in the U.S.–China trade war

Dutch banks cut savings rates—again

Bonds under scrutiny: the real (inflation-adjusted) story

Dollar vs. euro: what’s driving the currency shift?

The U.S. loses its coveted AAA credit rating

Europe ramps up defense spending: what that means for fiscal policy

U.S. inflation surprises to the downside, but remains above target

In addition to my other posts, this monthly newsletter gives you the latest updates on the Blokland Smart Multi-Asset Fund, along with key market insights and practical tips for building long-term wealth.

Want to benefit from these smart investment opportunities? Book a call or get in touch to learn how the Blokland Smart Multi-Asset Fund can help grow your capital.

I also regularly host events to connect in person and explore the opportunities the fund offers.

Happy reading!

Best regards,

Jeroen Blokland

1. Trump Strikes Deal with China, Markets Rebound

A temporary truce has been declared in the ongoing trade war between China and the United States. Tariffs have been reduced to 30% and 10%, respectively, and both powers have agreed to a three-month window to negotiate a more lasting and structural agreement.

The critical question now: will businesses and consumers return to normal behavior, or will caution prevail?

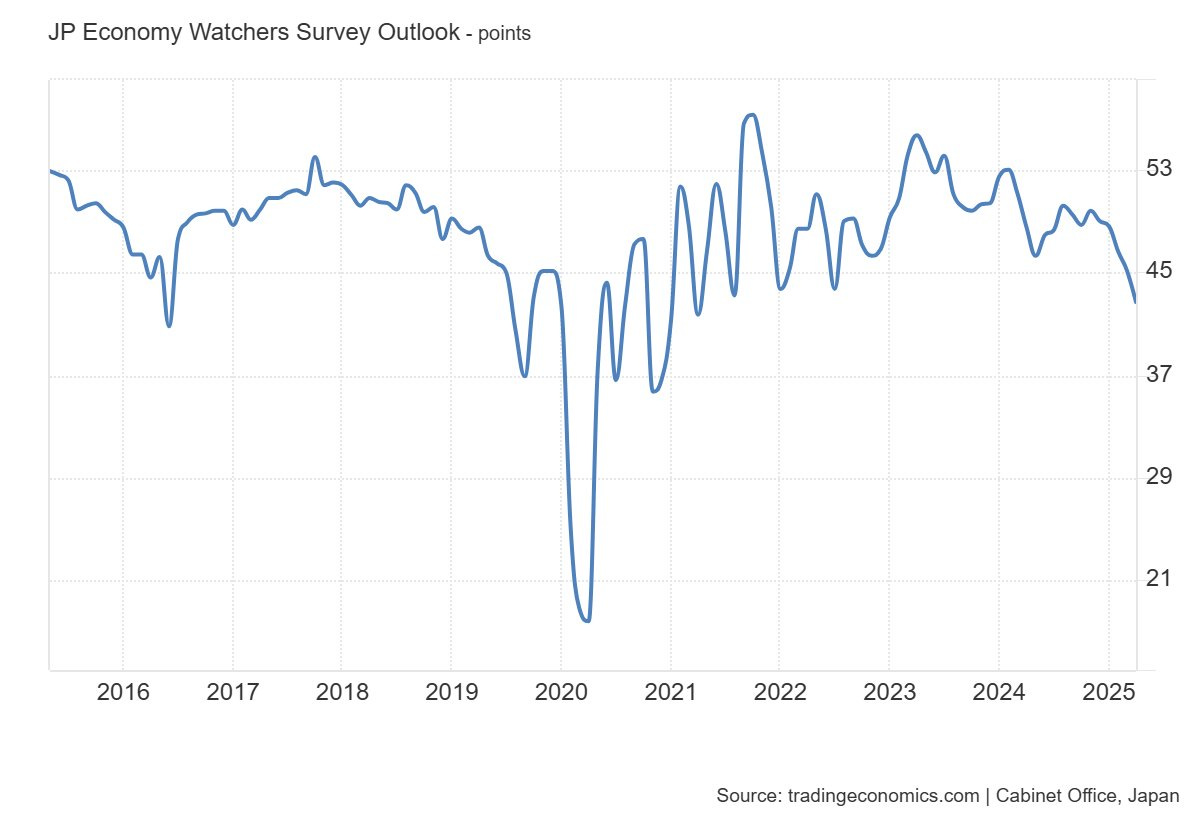

Business confidence among Japan’s largest companies, highly dependent on global trade, has fallen to its lowest level since April 2021 (see chart below).

Ultimately, the behavior of businesses and households will determine whether this proves to be a minor disruption or the prelude to a broader recession.

For now, investors have embraced the ceasefire. Equity markets across the U.S., Europe, and Asia moved higher in response.

The U.S. dollar strengthened following the agreement, while traditional safe havens like gold lost ground. Still, the threat of recession remains due to prior economic damage and persistent uncertainty.

2. Dutch Banks Are Failing Savers

Inflation in the Netherlands surged to 4.1% in April. Meanwhile, the country's largest banks have further reduced savings rates, leaving Dutch savers increasingly vulnerable.

ABN AMRO now offers just 1.25% on savings. Rabobank provides 1.5%, but only for balances below €20,000. ING’s terms are worse still: 1.25% up to €10,000 and a paltry 1.0% beyond that. Combined, these banks control over 80% of the market.

With inflation at 4.1% and savings yields at 1%, Dutch households are losing purchasing power at an alarming rate. With total savings of €600 billion, this implies an annual erosion of €18 billion in real wealth.

Obviously, this is for the specific case of my home country, the Netherlands. But how is this in yours? My advice: escape inflation’s grip by investing in scarce assets. The Blokland Smart Multi-Asset Fund does this for you, offering a diversified, professionally managed portfolio with disciplined risk oversight and transparent reporting.

3. A Real Look at Bonds

Why are bond returns rarely shown net of inflation? I pose this question in my latest blog, though the answer is straightforward.

It amazes me how many traditional investors remain anchored to obsolete assumptions. Just last week, an asset manager told me, once again, that his rigid two-asset-class portfolio (stocks and bonds) would not change, despite rising client demand. His rationale was the usual mix of tired platitudes.

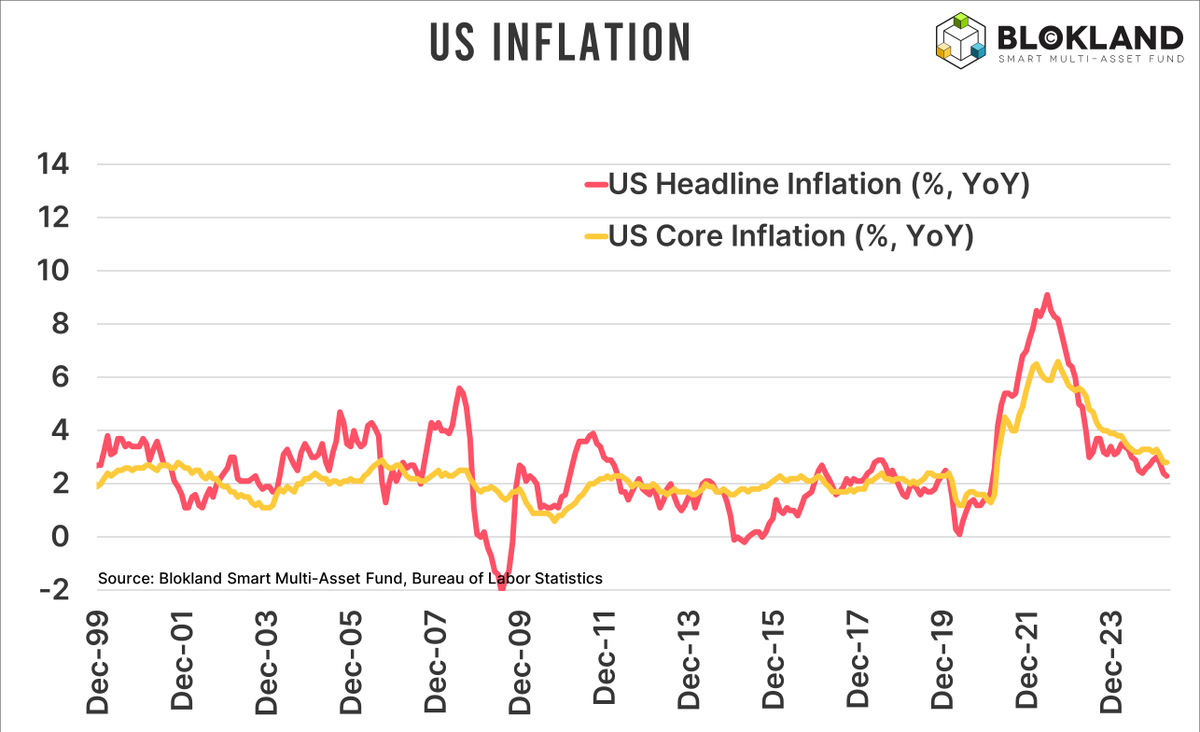

Inflation is routinely ignored in performance discussions. But if you adjust bond returns for inflation, the results are devastating.

The 10-year rolling real return on U.S. Treasury bonds tells the story. Since Paul Volcker raised rates to 20% in the 1980s, inflation-adjusted returns have declined steadily, turning profoundly negative in recent years.

In an industry that punishes even two years of underperformance, it’s astonishing how little introspection has been applied to the outdated 60/40 portfolio. And no, private equity and private debt aren’t the solution. They are still just equity and debt, often with opaque valuation methodologies.

The real issue: portfolios are passively constructed around failing assumptions. Bonds, structurally, have become wealth-destroyers. Yet the industry remains obsessed with ESG checklists and passive-versus-active debates while ignoring the foundational question: Is the traditional portfolio model still viable?

4. Weak Dollar

The weakening U.S. dollar is placing pressure on euro-denominated returns. For instance, while gold may rally strongly in USD, the move is often muted, or even absent, when priced in euros.

Is the euro’s strength sustainable?

Yes, if dollar hegemony weakens and the reserve currency premium erodes.

Yes, if the Fed aggressively eases monetary policy.

No, if markets realize the euro remains structurally tied to the dollar in the global currency system.

No, if debt sustainability fears in Southern Europe resurface, exposing the eurozone’s fault lines.

No, if eurozone policymakers opt to protect the remnants of their export-driven growth model by weakening the euro via lower interest rates.

No, if the dollar is still considered "the cleanest dirty shirt."

No, if Trump concludes that dollar dominance requires a strong dollar, not a weak one.

5. Moody’s Downgrades U.S. Credit Rating

Moody’s has stripped the U.S. of its AAA rating. While symbolic, the downgrade is significant.

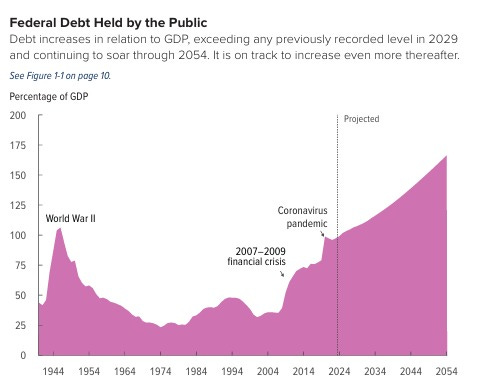

With deficits ballooning, debt at 100% of GDP, and entitlement spending set to explode, the U.S. has long fallen short of AAA fundamentals. Other agencies downgraded the U.S. years ago.

Key implications:

Bond market volatility will rise.

Institutions will seek alternatives to “risk-free” assets, supporting gold and Bitcoin.

The dollar may weaken further until investors recall that every other major fiat currency is weaker or dollar-linked.

Appetite for holding bonds will decline, something Modern Monetary Theory fails to address.

Ownership becomes more attractive than lending.

In short, the downgrade should be a catalyst for portfolio rebalancing, not a sign of systemic collapse.

6. Europe’s Expanding War Chest

European defense budgets are surging. Germany now targets 5% of GDP for defense. With government debt at 62.5% of GDP, this remains manageable.

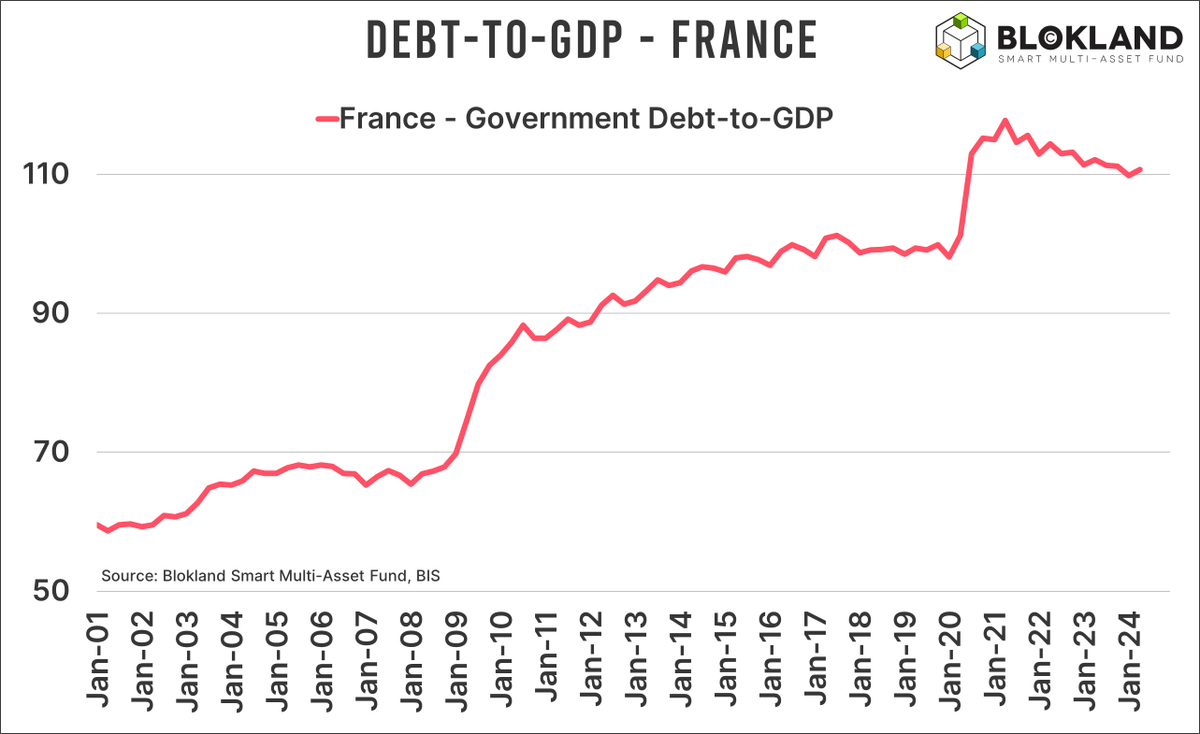

However, France, currently spending just 2% on defense, has a debt ratio of 113%. Rising defense costs will strain its already fragile fiscal position.

Expect:

Lower policy rates

Persistent inflation

Intensified political polarization

Continued erosion of Europe’s welfare states

7. U.S. Inflation Slightly Below Expectations

U.S. headline inflation came in at 2.3% in April, slightly below expectations. Core inflation held steady at 2.8%. Still, both figures remain above the Fed’s 2% target.

8. Upcoming Event: Gryp op Goud – June 6

On Friday, June 6 at 15:30, the “Gryp on Goud” event will be held at Van der Valk Hotel in Breukelen.

9. Column: The Weakest Link

In my latest column for Investment Officer, I argue that ECB interest rate policy has abandoned its inflation mandate in favor of political survival.

Despite persistent inflation above 2% since June 2021, the ECB has already cut rates three times this year. Markets expect a further drop to just 1.75% by year-end.

This policy disproportionately benefits France, whose inflation is just 0.8% but whose fiscal outlook is deteriorating rapidly.

Conclusion: ECB policy is no longer about inflation but preserving the eurozone. And that leaves savers in countries like the Netherlands, where inflation is over 4%, without protection.

10. “Bitcoin Is Perfect Money” – Michael Saylor

In a recent keynote, MicroStrategy’s Michael Saylor made a compelling case for Bitcoin as the ultimate scarce asset, and “perfect money,” for the digital age.

With a hard cap of 21 million coins, Bitcoin offers unmatched protection against fiat debasement. Saylor envisions a future Bitcoin standard, where BTC replaces gold as the global store of value.

Bitcoin currently holds a 10% strategic allocation in the Blokland Smart Multi-Asset Fund.

Yet most traditional Dutch portfolios remain massively underweight. No gold. No Bitcoin. Just a lot of bonds. A strategy increasingly at odds with today’s financial reality.

11. Contact me directly

Are you interested in the Blokland Smart Multi-Asset Fund? You can schedule a call directly via this link! Beforehand, feel free to review the terms in the fund presentation, which you can find here.

You can also reach me at:

Phone number: +31 6 14 37 19 35

Email: jeroen@bloklandfund.com

Online meeting: Schedule an appointment here

That’s all for this edition. As always, feel free to reach out if you have any questions or would like to discuss your investment strategy further.

Let’s invest together!

Kind regards,

Jeroen