The Average Return Does Not Exist

Welcome to the 2026 edition, once again showing that professional investors are poor market forecasters

New year, new round. Every January, I look with the same mix of amazement and confusion at the equity market forecasts published by major financial institutions. And in particular at their projected returns, which almost always cluster tightly around the long-term average. A number you can be almost certain will not materialize.

A flawed forecasting strategy

Basing market forecasts on the long-term average return is an extremely poor crystal-ball strategy. The average return almost never occurs. You would be far better off being an eternal optimist or a committed perma-bear. At least those positions show conviction. The “let’s stay close to the average” forecasts do not.

The data

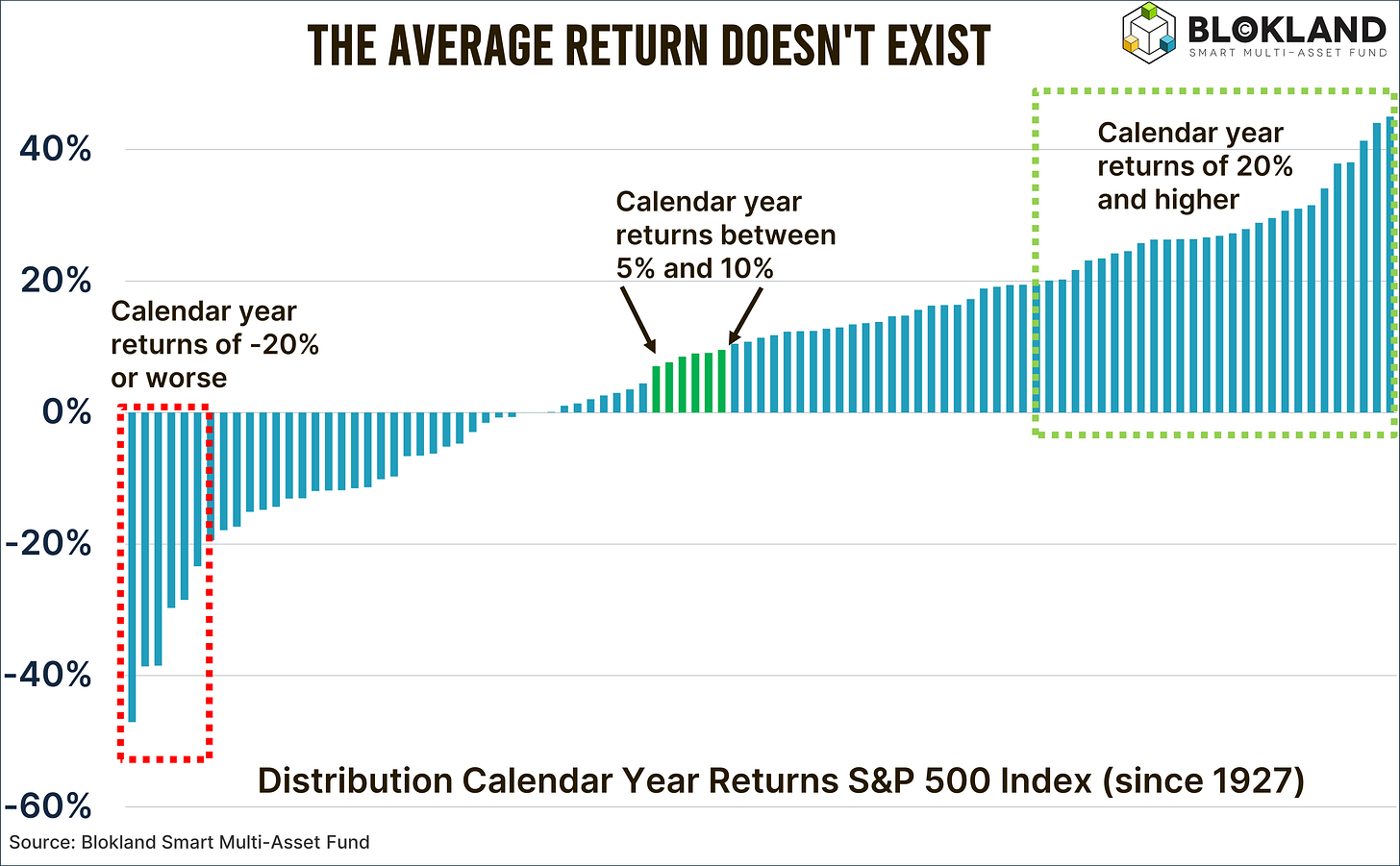

Since 1927, the back-calculated average annual return of the S&P 500 Index has been 8.1 percent. With only that number in mind, a forecast somewhere between 5 and 10 percent may sound pretty professional. But a closer look at the data quickly reveals the opposite. It mainly reflects a lack of historical insight.

In the 97 calendar years since 1927, the S&P 500 Index delivered a return within that 5 to 10 percent window only six times. Read that again. Just six times. And 2025 was no exception. The index returned 16.4 percent.

Those six years imply that a so-called market guru using a 5 to 10 percent forecast every year would have been right only about 6 percent of the time. That is not exactly impressive.

Go extreme

A far better strategy would have been to predict every year that equities would rise by at least 20 percent. In that case, you would have been correct 28 times, a hit rate of 29 percent. Yes, had you been “crazy” enough to forecast returns of 20 percent or more every single year, you would have been right almost one out of three times. That is a predictive accuracy five times higher than that of the average-huggers.

Even permanent pessimists would not have fared worse. Since 1927, the S&P 500 Index has declined by 20 percent or more six times as well. Because it takes far more courage to consistently issue such potentially career-limiting forecasts, I actually consider perma-bears to be better forecasters than those who cling to the average.

Once again, little historical awareness

This year’s professionals once again prove that they did not read my column titled “The average does not exist.” The median forecast of 21 strategists from the largest investment banks comes in at 9.4 percent. To be fair, that is slightly above the group’s usual comfort zone and marginally away from the long-term average. But of course it still sits neatly within the 5 to 10 percent bracket.

Eight of the 21 forecasters produced estimates between 5 and 10 percent. Roughly 40 percent of them. For this group, history implies a 94 percent probability of being wrong, as in 91 of the 97 years since 1927 the return fell outside that range. Last year, this share was close to 50 percent, so perhaps a few forecasters have started to see the light.

Or perhaps not.

Not a single strategist forecast a return above 20 percent. Not one. Despite the historical probability of such an outcome being 29 percent. You would expect at least a few of the 21 to have glanced at the historical return distribution. Apparently not.

Even more striking, none of the experts predicted a negative return. That is arguably even stranger, given that the probability of a negative calendar-year return is close to one third. The lowest forecast for 2026 was still a positive 2.3 percent.

It remains remarkable how poorly informed these forecasters appear to be about the return patterns of the asset class they are paid to understand.

More likely, they do know this. But the pressure to avoid being an outlier is simply too great. That fits perfectly with the broader picture of institutions that remain trapped in a world consisting of equities and bonds only. But that is a topic for another time.

Thank you for reading.

Kind regards,

Jeroen

Blokland Smart Multi-Asset Fund

Are you considering investing? Or does everything that has already happened this year make you rethink how your portfolio is structured?

The Blokland Smart Multi-Asset Fund helps investors do exactly that. The fund invests in a smart combination of quality stocks, physical gold, which is fully allocated in the name of the fund and securely stored in a Swiss vault, and bitcoin, a programmed form of digital scarcity. The latter two sit outside the traditional financial system and offer an additional layer of protection for your wealth.

Does this resonate with you and are you ready for the next step? Feel free to contact me at jeroen@bloklandfund.com. You can also call me directly. Full contact details and extensive information about the fund are available on our website.

Kind regards,

Jeroen Blokland