What? Family Offices Invest just 2% in Scarce Assets!

Investors, after another year dominated by headlines about debt, central banks, inflation, and interest rates, have missed the opportunity to get involved. But there is still time!

Welcome to a new edition of the Blokland Smart Multi-Asset Fund newsletter. Here, we keep you informed about the latest developments related to the fund and relevant market movements that align with its philosophy: in a world burdened by ever-increasing debt, scarce investments become more attractive.

Global Family Office Report

UBS recently published its Global Family Office Report for 2024, detailing the (strategic) asset allocation for 2023. A few months ago, I discussed its competitor, The European Family Office Report by Campden Wealth, which included the asset mix allocation for 2022. With growing concerns about the consequences of high interest rates (the largest regional banks in the US have disappeared), mounting debts (the charts on budget deficits and interest burdens are overwhelming), and increasing geopolitical tensions (Ukraine, Israel, China, and the United States), one might expect changes.

However, this is far from the case. After another year of particularly meager bond returns (zero to slightly negative), an excellent year for gold (an increase of over 10%), and a price explosion for Bitcoin (an increase of about 150%), the portfolios look just as outdated as they did a year ago. This contradicts my earlier claim that Family Offices are more progressive than traditional asset managers. But perhaps this newsletter will bring about a change.

Count on One Hand

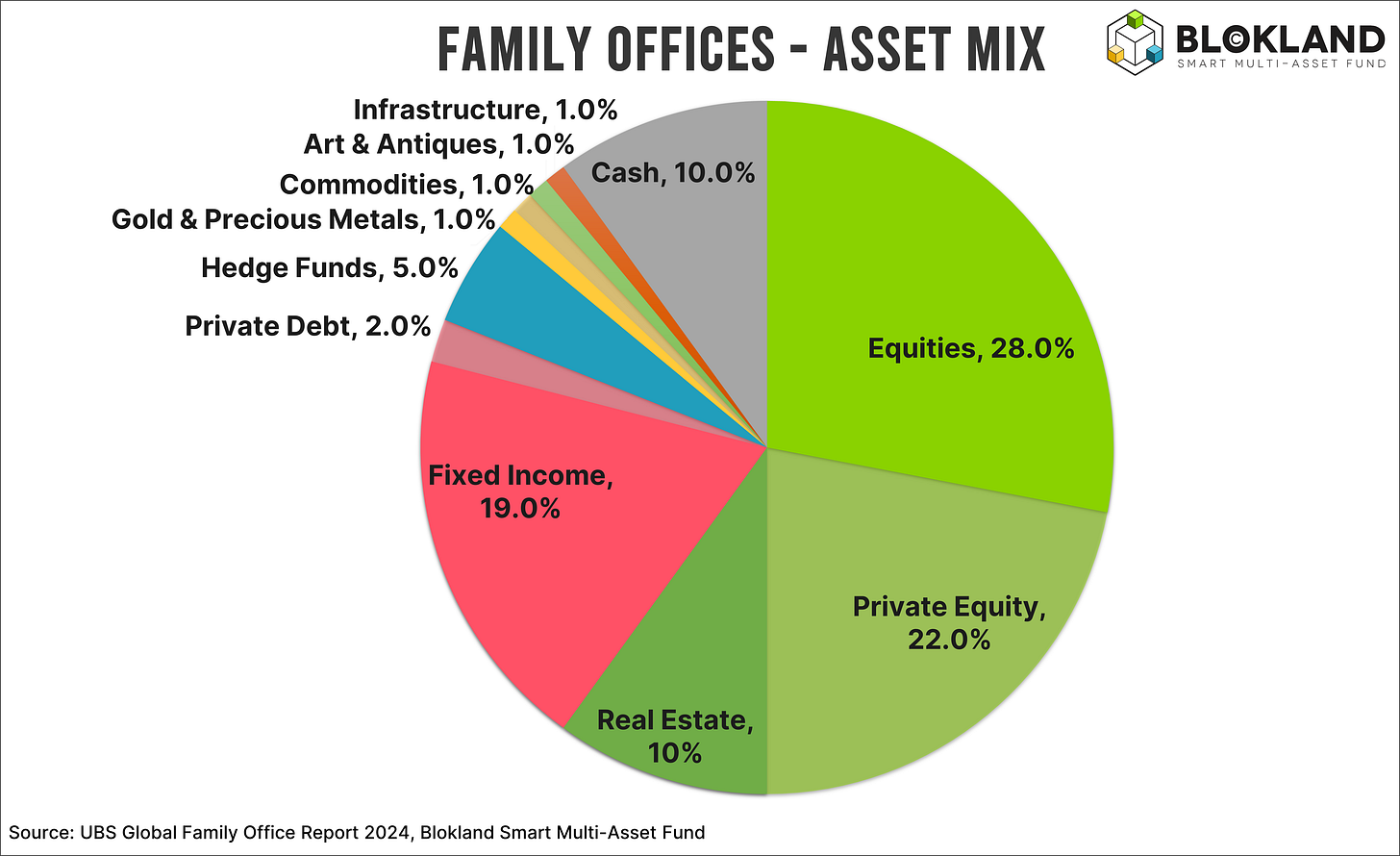

Below is the average asset mix of family offices worldwide. They invest, believe it or not, roughly 2% in what most investors consider scarce asset classes: 'Gold & Precious Metals' and 'Art & Antiques.' Bitcoin is not included in the asset mix at all. For completeness, I do not consider commodities inherently scarce, as they are a particularly heterogeneous group, with some members not scarce (food- and livestock-related commodities) and others not necessarily scarce (energy- and metal-related commodities).

That 2% is startlingly little. This likely means that the vast majority of family offices do not invest in gold (or art) at all. Apart from the fact that our financial system demands structurally low interest rates due to the enormous pile of debt, which brings uncertainty regarding central bank policy and inflation, these investors are missing out on a lot of 'free' diversification.

A Golden Combination

As I showed in the newsletter a few weeks ago, stocks and gold go together well. Gold provides significant loss limitation when stock markets really go awry. Below is the chart showing equity and gold returns during the 20 worst months for stock markets since 2008. On average, stocks fell 7.3%, while the price of gold increased by an average of 2.1% during those months.

What you might not know is that even though interest rates have almost exclusively declined over the past decades, a 60-40 portfolio containing 60% stocks and 40% gold in terms of risk-reward ratio would, by no means, have been inferior to the traditional 60-40 portfolio containing 40% bonds. In fact, since 2003, the 60-40 gold portfolio has outperformed the classic 60-40 portfolio!

Hot Air

Returning to the asset mix of Family Offices. What also stands out is the vast allocation to private equity. Globally, it accounts for almost a quarter (22%) of the portfolio. In the US, family offices invest as much as 35% of their assets in private equity. And this is despite the fact that at least half of the investment case for private equity is 'hot air.'

Before I dig deeper into that, due to the illiquidity associated with private equity (you can't just exit), the greater default risk, and the significantly higher costs (2% per year is no exception), the return on private equity simply has to be higher to make it attractive compared to listed companies.

But equally important, private equity is NOT less risky than stocks. The default story that private equity has lower volatility than stocks is simply not true. The reported lower volatility is the result of a valuation trick. Private equity investments are valued only every so often. If it concerns a portfolio of private equity investments, only a part of the total portfolio is revalued in most cases.

Moreover, those valuations are quite subjective. Research shows that different parties value the same investment totally differently, resulting in percentage point differences in valuation levels. Generally, private equity valuations are 'smoothed,' with artificially low volatility as the outcome.

Private Equity Brings Little Risk Diversification

Fortunately, private equity returns can be 'desmoothed,' which provides a clearer picture of its actual risk-return characteristics. The table below from Venn by Two Sigma, a data science company, shows this for a well-known private equity index since 2001. The second column (Preqin Private Equity Desmoothed) shows the risk-return characteristics after the desmoothing. The third column (Preqin Private Equity Index) shows the reported figures, and the fourth column holds the S&P 500 Total Return Index data, allowing a comparison with publicly traded stocks.

The key points:

The return on private equity was indeed higher than that on publicly traded stocks over the past 20 years. However, I wonder how beneficial it would have been after accounting for the costs and considering that the money is tied up for longer.

The 'desmoothed,' or actual volatility (16.64%), is 80%(!) higher than the reported volatility.

The desmoothed volatility is almost as high as the volatility of publicly traded stocks (here, the S&P 500 Total Return Index).

As a result, the actual Sharpe ratio, the return divided by volatility, is nearly half of what is reported.

Moreover, the correlation with the S&P 500 Total Return Index is quite high, at 0.87, indicating that these two investment categories almost always move in the same direction. For comparison, the correlation between stocks and gold & Bitcoin is generally close to zero.

The maximum drawdown, or the largest measured decline since 2001, is over 46%. This is much more than reported and also more than that of the S&P 500 Total Return Index.

It should be clear that private equity as an investment is not much different from publicly traded stocks. They are both called 'equity' for a reason. If you are trying to achieve additional return with private equity, that's fine, but it adds little in terms of risk diversification. Moreover, with the massive rush into private equity, the likelihood of actually realizing those higher returns decreases.

Conclusion

Even though the consequences of an abundance of debt, fiat money, and central bank balances become clearer daily, the asset mix of most family offices has hardly adjusted to this. However, with structurally low interest rates, inflation uncertainty, and higher volatility of bonds and private equity, it seems only a matter of time before they and other traditional investors make a move. Hence, it is important not to be the last to cross.

Interested in the Blokland Smart Multi-Asset Fund?

Do you, privately or on behalf of your clients, want to invest in Quality Stocks, physical gold, and Bitcoin, through an innovative investment solution that aligns with your goals? Contact me at jeroen@bloklandfund.com or visit the website.

Want to have a call first? Use this link to book a one-on-one conversation and choose a suitable time slot. You can opt for a Zoom meeting or a phone call. Please note that the minimum entry amount is EUR 250k, which can be lowered to a minimum of EUR 100k in consultation.

Let’s invest together!

Kind regards,

Jeroen